How To Use Quantum Algorithms For Stock Market Insights

Understanding and predicting stock market movements has always been a complex challenge that analysts and traders approach using traditional algorithms and models. However, as technology advances, a new tool on the horizon could revolutionize how we gain insights into the stock market: quantum algorithms.

What Are Quantum Algorithms?

To grasp the potential of quantum algorithms in stock market analysis, it's essential to understand what they are. Traditional algorithms, which power our computing devices daily, rely on classical bits. These bits can either be in a state of 0 or 1, forming the foundation of binary computing. Quantum algorithms, on the other hand, operate on quantum bits or qubits.

Qubits are fundamentally different because they can exist in multiple states simultaneously, thanks to a property known as superposition. This allows quantum computers to process a vast amount of data in parallel, making them incredibly powerful for solving complex problems. Additionally, qubits can be entangled, meaning the state of one qubit is directly related to the state of another, no matter the distance between them. This phenomenon allows quantum algorithms to perform computations faster than their classical counterparts.

In simple terms, while classical algorithms linearly process data, quantum algorithms can process multiple possibilities simultaneously, offering the potential to solve problems currently intractable for classical computers.

Why Quantum Algorithms Matter In The Stock Market

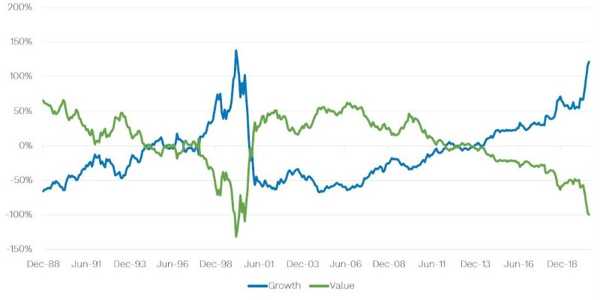

The stock market is a complex system influenced by countless variables, from economic indicators to geopolitical events. Traditional algorithms analyze historical data and use statistical methods to predict future market trends. However, these algorithms are limited, especially when processing large datasets and identifying patterns that are only sometimes obvious.

Quantum algorithms can change the game in several ways:

Speed and Efficiency:

Quantum computers can analyze massive datasets much faster than classical computers. This speed is crucial in the stock market, where real-time decisions must be made. A quantum algorithm can quickly sift through years of data to identify trends, correlations, and anomalies that might go unnoticed with classical methods.

Complex Problem Solving:

The stock market is shaped by many factors that interact in complicated ways. Quantum algorithms can handle these complexities better by considering multiple variables simultaneously and processing all potential outcomes. This allows for more accurate predictions and a deeper understanding of market behaviour.

Optimization: Many financial strategies involve optimizing portfolios, balancing risk versus return, and minimizing costs. Quantum algorithms excel at optimization problems, potentially leading to more efficient and profitable trading strategies.

Pattern Recognition: Identifying patterns in the stock market is critical to predicting future movements. Quantum algorithms can enhance pattern recognition by analyzing data in more dimensions than classical algorithms can manage, potentially uncovering hidden correlations that can be exploited for trading advantages.

How To Use Quantum Algorithms For Stock Market Insights

Now that we've covered the basics of quantum algorithms and their potential in the stock market, How can they be practically applied?

Portfolio Optimization

One of the most promising applications of quantum algorithms in finance is portfolio optimization. Traditional portfolio optimization methods, like the Markowitz model, work by maximizing returns for a given level of risk. However, as the number of assets in a portfolio increases, the complexity of the problem grows exponentially. Quantum algorithms, particularly those based on the Quantum Approximate Optimization Algorithm (QAOA), can handle this complexity more efficiently, potentially finding better solutions faster than classical methods.

For instance, a quantum algorithm could evaluate all possible combinations of assets in a portfolio to identify the one that offers the best return for a given level of risk. This optimization level could help investors build more profitable and resilient portfolios to market fluctuations.

Risk Analysis

Quantum algorithms can improve risk analysis by processing large volumes of historical and real-time data. They can model complex financial instruments and assess their associated risk more accurately. For example, in the case of derivatives, which are often complex and involve multiple underlying assets, quantum algorithms could analyze how these assets interact under different scenarios, offering a more comprehensive risk assessment.

Algorithmic Trading

High-frequency trading (HFT) firms rely on algorithms to execute trades within fractions of a second. The faster and more accurately these algorithms can analyze market data, the better the trading outcomes. Quantum algorithms could enhance HFT by processing market data at unprecedented speeds and identifying profitable trading opportunities before classical algorithms pick them up. This speed advantage could increase profits in a highly competitive trading environment.

Market Prediction

Predicting market trends is one of the holy grails of finance. Quantum algorithms could significantly improve market prediction models by quickly processing and analyzing vast datasets. By considering more variables and processing data in parallel, quantum algorithms could offer more accurate forecasts, helping traders and investors make better-informed decisions.

Fraud Detection

The stock market is also at risk for fraudulent activities like insider trading and market manipulation. Quantum algorithms can help detect fraud by analyzing trading patterns and identifying anomalies that might indicate illegal activities. With enhanced pattern recognition capabilities, quantum algorithms could spot fraudulent behaviour more effectively than traditional methods.

Sentiment Analysis

Sentiment analysis involves analyzing news articles, social media posts, and other forms of communication to gauge the market's mood. Quantum algorithms could enhance sentiment analysis by processing this unstructured data more efficiently and accurately, offering insights into how market sentiment might influence stock prices.

Conclusion

Quantum algorithms can potentially revolutionize how we gain insights into the stock market. These algorithms can provide more accurate predictions and better trading strategies by offering faster data processing, better optimization, and enhanced pattern recognition. While the technology is still in its early stages, the future of quantum computing in finance looks promising.

However, it's important to note that quantum computing is not yet widely accessible. Developing and implementing quantum algorithms requires specialized knowledge and infrastructure that most financial institutions need to gain. However, as technology matures and becomes more available, it could become an invaluable tool for anyone looking to gain a competitive edge in the stock market.