When Is The Best Time To Buy Tech Shares?

Investing in tech stocks can be exciting but also tricky. The technology sector is known for its rapid growth but can also be volatile. Knowing when to buy tech shares can significantly affect your returns. This article will explore key factors that can help you decide when to invest in tech stocks. We'll cover market cycles, economic indicators, company performance, and other practical considerations to guide your decisions.

Understanding Market Cycles

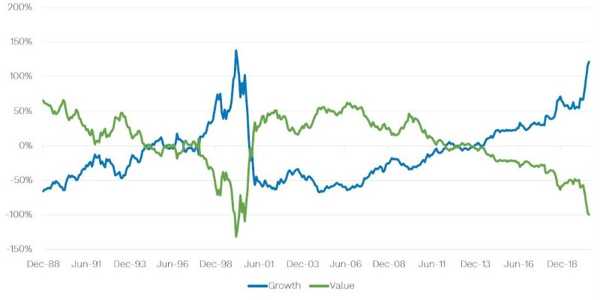

Tech stocks often move in cycles, just like the broader market. Various factors influence these cycles, including economic conditions, interest rates, and investor sentiment. The stock market generally goes through four phases: expansion, peak, contraction, and trough.

Expansion: This is when the economy is growing, companies are doing well, and stock prices are generally rising. During this phase, tech stocks often perform well because investors are optimistic about future growth.

Peak: At the peak of the market cycle, stock prices reach their highest levels. This is often followed by a sense of caution among investors. While buying during this time is tempting, tech stocks may be overpriced, leading to lower potential returns.

Contraction: During a market contraction, the economy slows down, and stock prices fall. Tech stocks can drop significantly during this phase because they are often more sensitive to changes in economic conditions.

Trough: The trough is the bottom of the market cycle. It’s a time when stock prices are generally at their lowest. This phase can present opportunities to buy tech stocks at a discount, but it can be challenging to time the bottom accurately.

Understanding where we are in the market cycle can help you decide when to buy tech shares. While it’s impossible to time the market perfectly, buying during the expansion or early in the trough phase may increase your chances of making profitable investments.

Economic Indicators To Watch

Economic indicators provide valuable insights into when buying tech stocks is an excellent time. Here are a few key indicators to consider:

Interest Rates: Low interest rates can benefit tech stocks because they make borrowing cheaper for companies and encourage consumer spending. Investing in tech shares might be a good time when interest rates are low. However, rising interest rates can lead to a pullback in tech stocks as borrowing costs increase and investors shift to more conservative investments.

GDP Growth: A growing economy, including the tech sector, often supports higher stock prices. If GDP increases, investing in tech stocks is a good time. Conversely, a shrinking GDP might indicate an economic downturn, leading to a decline in tech stock prices.

Unemployment Rates: Low unemployment rates indicate a strong economy, which is generally good for tech stocks. High employment usually means more consumer spending, which can drive revenue growth for tech companies.

Inflation Rates: Moderate inflation can benefit tech stocks, indicating a growing economy. However, high inflation can lead to higher company costs and lower consumer spending, negatively impacting tech stocks.

By monitoring these economic indicators, you can better assess whether the environment is favourable for investing in tech stocks.

Company-Specific Factors

Beyond market cycles and economic indicators, it’s essential to consider the performance and outlook of individual tech companies. Here are some factors to watch:

Earnings Reports: Quarterly earnings reports provide insights into a company's financial health. Look for companies that consistently meet or exceed earnings expectations, which can sign strong performance. However, be cautious of companies that frequently miss earnings targets, as this could indicate underlying issues.

Product Launches and Innovations: Tech companies thrive on innovation. A new product launch or breakthrough technology can increase a company's stock price. If you believe in a company's product pipeline, it might be a good time to buy shares before the market fully realizes its potential.

Market Share and Competitive Position: Companies with a substantial market share and competitive advantage are often better positioned to weather economic downturns and capitalize on growth opportunities. Investing in tech stocks with a solid competitive position can be a safer bet.

Management Team: A strong management team can significantly affect a tech company's success. Look for companies with experienced leadership and a track record of making smart strategic decisions.

Timing Your Investment

While it’s essential to consider market cycles, economic indicators, and company-specific factors, timing your investment is also crucial. Here are some strategies to help you decide when to buy tech shares:

Dollar-Cost Averaging: This strategy involves investing a fixed amount of money into tech stocks at regular intervals, regardless of the stock's price. Dollar-cost averaging helps you avoid the risks of attempting to time the market perfectly and lessens the effect of market volatility on your investments.

Buying on Dips: If you believe in the long-term potential of a tech stock, buying on dips can be a good strategy. This means purchasing shares when the stock price drops due to short-term factors, such as market corrections or temporary setbacks. However, ensuring that the company's fundamentals remain strong before buying is essential.

Following Market Sentiment: Investor sentiment can significantly influence tech stock prices. When the market is overly optimistic, tech stocks may become overpriced. Conversely, when the market is pessimistic, tech stocks may be undervalued. Keeping an eye on market sentiment can help you identify buying opportunities.

Long-Term Perspective: If you believe in the long-term growth potential of a tech company or the sector as a whole, it may be worth investing regardless of short-term fluctuations. A long-term perspective can help you ride out market volatility and benefit from the compounding growth of your investments.

Conclusion

The best time to buy tech shares depends on various factors, including market cycles, economic indicators, company performance, and investment strategy. While, ideally, predicting the market is impossible, knowing these factors can help you make more informed decisions.

If you're a long-term investor with a high tolerance for risk, buying during market dips or periods of economic uncertainty can offer opportunities for significant returns. On the other hand, if you're more risk-averse, consider dollar-cost averaging or waiting for more favourable market conditions.