Why Market Volatility Creates Buying Opportunities

Market volatility often evokes feelings of uncertainty and risk for many investors. The constant shifts in market prices can make it challenging to know when to enter or exit positions. This article will delve into how market volatility can create these opportunities and why savvy investors might view these fluctuations not as threats but as pathways to profitable investments.

What Is Market Volatility

Market volatility refers to the degree of variation in the price of assets, such as stocks, bonds, and commodities, over a given period. When the market experiences large price swings in a short amount of time, it is deemed volatile. These fluctuations can be caused by various factors, including economic events, political instability, changes in investor sentiment, or even natural disasters. Volatility is often viewed as a sign of uncertainty or risk. Still, it also represents the potential for significant returns, particularly for long-term investors who are willing to take on some level of risk.

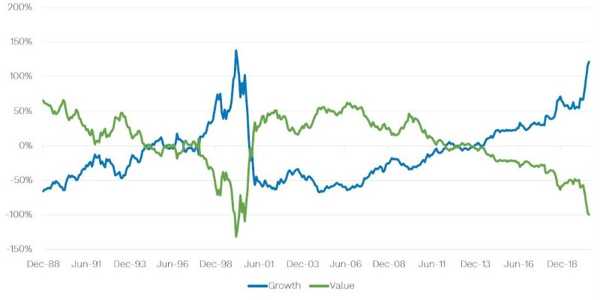

The Link Between Volatility And Buying Opportunities

While volatility can cause anxiety among many investors, it often creates attractive opportunities for those with the right mindset and strategy. One of the primary ways that market volatility presents buying opportunities is through price dislocations. When markets react strongly to news or events, they sometimes overreact, causing assets to become undervalued. These temporary mispricings can be seized by investors who are able to identify solid companies or assets with long-term growth potential that have been unfairly punished in the short term.

Identifying Undervalued Assets During Volatility

The key to capitalizing on market volatility lies in the ability to identify undervalued assets. During times of market upheaval, many stocks or other investments may be sold off indiscriminately, even if the underlying business or asset has not been fundamentally impacted. For example, a company might experience a sharp drop in its stock price following a temporary crisis, such as a product recall or executive scandal, even if the long-term growth prospects remain intact.

For an investor, these situations can create an ideal opportunity to buy high-quality assets at a discount. The challenge, however, lies in distinguishing between true value and fleeting market noise. To be successful in such conditions, an investor must carefully analyze financial statements, assess the long-term viability of the business model, and determine whether the price decline is truly reflective of the company’s future potential.

Volatility As A Tool For Timing Market Entries

Another way that market volatility creates buying opportunities is by providing an entry point into the market at favourable prices. In a stable or bullish market, prices tend to rise gradually, often making it difficult for investors to time their purchases at a point that will yield the highest returns. However, in times of volatility, there are often sharp dips in price that present more compelling entry points. These sudden drops can allow investors to enter the market at a lower cost, which can increase their potential for profit once the market stabilizes or returns to its upward trend.

Furthermore, volatility can also lead to the creation of short-term trading opportunities. Traders who are willing to act quickly in response to market changes can take advantage of rapid price fluctuations. For example, day traders or swing traders might buy and sell positions based on short-term volatility, seeking to profit from quick price movements. While this strategy requires skill and market knowledge, it can be very rewarding when executed properly.

The Risk-Reward Dynamic In Volatile Markets

Volatility inherently carries a certain level of risk. The value of investments can swing dramatically in both directions, which can lead to potential losses for investors who are caught off guard. However, with higher risk comes the possibility of higher rewards. For long-term investors, market volatility can be seen as an opportunity to purchase assets at a lower price, increasing the potential for gains when those assets appreciate in the future. The risk-reward dynamic plays a crucial role in how investors approach volatile markets, and those who are able to manage risk effectively often find themselves in a favourable position to benefit from market fluctuations.

Investors who are able to withstand short-term volatility may ultimately see the rewards in the form of long-term capital appreciation. By purchasing undervalued assets during times of high market stress and holding them until they recover, investors can reap the benefits of market cycles, which tend to favour growth over the long run. This strategy can also help to reduce the impact of temporary market disruptions on an investor's overall portfolio.

Volatility And The Role Of Diversification

One of the most effective ways to mitigate the risks associated with market volatility is through diversification. By spreading investments across a variety of asset classes—such as stocks, bonds, real estate, and commodities—investors can reduce the impact of market swings on their overall portfolio. During times of heightened volatility, some assets may perform poorly while others may hold up better or even increase in value. Diversification can help to smooth out the fluctuations in a portfolio, providing stability while still allowing investors to take advantage of buying opportunities in volatile markets.

Diversifying across industries or geographic regions can also be an effective way to reduce risk. For instance, an investor who holds stocks in various sectors such as technology, healthcare, and energy may find that the overall portfolio is less impacted by volatility in a single industry. This approach helps ensure that if one sector suffers from market fluctuations, others may offset the losses, creating a more balanced portfolio.

Conclusion

Market volatility, while often viewed as a source of anxiety and risk, can create significant buying opportunities for investors who are able to recognize the potential for profit. By understanding how volatility leads to price dislocations, identifying undervalued assets, timing market entries, and managing risk effectively, investors can turn periods of uncertainty into moments of financial opportunity.

With the right strategy, market volatility becomes not something to fear but a powerful tool for growth and wealth accumulation. By approaching volatility with patience, discipline, and a long-term perspective, investors can unlock the potential for substantial returns in even the most tumultuous market conditions.