What Makes Personalized Nutrition Stocks a Good Bet?

Investing in the stock market has always been about identifying trends before they hit the mainstream. One of the emerging sectors that are capturing the attention of investors is personalized nutrition. This isn't just a buzzword; it's a growing field that merges the latest in health science with technology to create custom dietary solutions for individuals. But why is this sector a good bet for investors? Let's break it down.

Growing Awareness Around Health And Wellness

Health and wellness are no longer niche topics. Today, people are more conscious about what they eat and how it affects their health. The global pandemic only accelerated this awareness, pushing more people to consider their diets and lifestyles. Personalized nutrition takes this further by offering customized dietary plans based on an individual's genetic makeup, lifestyle, and health goals.

This shift toward personalized health solutions is driving demand in the market. As people become more health-conscious, the appeal of one-size-fits-all diets is waning. Consumers want something tailored to their unique needs, and they’re willing to pay for it. This rising demand creates a fertile ground for companies in the personalized nutrition space, making them attractive targets for investors.

Advances In Technology

The rise of personalized nutrition is only possible with technological advancements. With the growth of wearable devices, AI, and big data, companies can now gather and analyze vast amounts of information about a person's health and habits. This data is then used to create concrete dietary recommendations.

For instance, DNA testing kits are becoming more affordable and accessible, allowing consumers to get detailed insights into their genetic predispositions. Apps can track what you eat, how much you exercise, and even your sleep patterns, giving a comprehensive view of your health. These technological tools empower consumers and provide a steady data stream companies can use to refine and improve their offerings.

Investors recognize the value of technology in personalized nutrition. Companies that leverage advanced tech to deliver better, more accurate services will likely see increased customer loyalty and, consequently, higher revenues. This potential for growth makes personalized nutrition stocks an appealing option for those looking to invest in the next big thing.

Shift From Reactive To Preventative Health

Traditional healthcare has long been reactive, focusing on treating illnesses after they occur. However, there's a growing shift toward preventative health, emphasizing preventing diseases before they happen. Personalized nutrition plays a critical role in this shift. By understanding an individual's unique nutritional needs, these services can help people avoid health issues down the line.

For example, a person with a genetic predisposition to high cholesterol might receive a diet plan specifically designed to keep their cholesterol levels in check. Someone prone to diabetes could get a personalized plan that helps manage blood sugar levels. This proactive approach to health is better for individuals and helps reduce the burden on healthcare systems, making it a win-win situation.

This preventative focus is another reason personalized nutrition stocks are a good bet. As more people and healthcare providers shift toward preventative care, companies in this space are well-positioned to capture a growing market.

Consumer Willingness To Spend On Health

Another factor driving the personalized nutrition market is consumer willingness to spend on health-related products and services. People are increasingly viewing health as an investment, not just an expense. This mindset shift means consumers are more likely to pay a premium for personalized nutrition plans that promise better health outcomes.

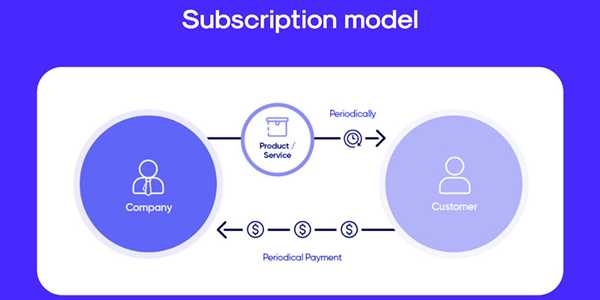

Moreover, subscription models are becoming popular in the personalized nutrition sector. Companies offer monthly or yearly plans that provide continuous support and updates based on an individual’s changing health data. These subscription services create a steady revenue stream for companies, which is attractive to investors looking for stability in a volatile market.

Diverse Revenue Streams

Companies in the personalized nutrition sector often have multiple revenue streams, which adds to their appeal to investors. These include direct-to-consumer sales, partnerships with healthcare providers, corporate wellness programs, and even licensing deals for their technology.

For instance, a company might sell DNA testing kits directly to consumers while partnering with gyms or wellness centres to offer their services. They might also license their data analytics platform to other companies in the health and wellness industry. This diversity in revenue sources helps mitigate risk and ensures a more stable financial outlook, making these companies a safer bet for investors.

Competitive Landscape And M&A Potential

The personalized nutrition sector is still in its early stages but is rapidly becoming more competitive. New players are entering the market, and existing companies are expanding their offerings. This competition drives innovation, leading to better products and services for consumers.

This competitive landscape presents an opportunity for investors. As companies strive to outdo each other, those who emerge as leaders will likely see significant growth in their stock value. The potential for mergers and acquisitions (M&A) in this space is also high. Larger companies might acquire smaller, innovative firms to expand their offerings and customer base. Such M&A activity can yield significant returns for investors holding stocks in these smaller companies.

Regulation And Data Privacy Considerations

While the personalized nutrition market has great potential, it has many concerns. One of the biggest concerns is regulation and data privacy. As these companies collect and analyze large amounts of personal health data, they must navigate a complex landscape of privacy laws and regulations.

Investors should monitor how companies handle data privacy and regulatory compliance. Companies that manage these aspects well will likely succeed in the long run. On the other hand, those that fail to protect consumer data or violate regulations could face significant setbacks, affecting their stock performance.

Conclusion

Personalized nutrition stocks represent a compelling investment opportunity for several reasons. The growing awareness around health and wellness, advances in technology, shift toward preventative health, and consumer willingness to invest in their health all contribute to the sector's potential. Additionally, the diverse revenue streams, competitive landscape, and long-term growth prospects make these stocks a good bet for investors looking to capitalize on the next big trend in health and wellness.